Historically, inflation has played a significant role in shaping investment strategies and decisions. It is widely known that high inflation can erode the value of investments, including property assets. However, the recent decline in UK inflation offers a unique advantage for property investors.

Today's unexpected development is great news for those looking to enter the property market or expand their existing portfolios. As the saying goes, when the tide turns, it turns fast.

Here's why now is the perfect time to capitalise on this potentially favourable trend.

1. Increased purchasing power:

- Falling inflation means that the purchasing power of the pound strengthens.

- As property prices are often linked to the prevailing economic conditions, this downturn in inflation may lead to more attractive buying opportunities.

- Property investors can now potentially secure prime assets at lower prices, maximising their returns in the long run.

2. Favourable borrowing conditions:

- Lower inflation rates often go hand in hand with lower interest rates.

- This presents an excellent opportunity for property investors who rely on financing to grow their portfolios.

- Reduced borrowing costs can significantly improve the profitability of investments, making it easier for individuals to enter the property market or expand their existing holdings.

3. Anticipated market upturn:

- As we have witnessed throughout history, the property market tends to be cyclical.

- After an extended period of high inflation, the decline in inflation could indicate an upcoming market upturn.

- By getting in now, property investors can position themselves to benefit from the inevitable rebound in property prices and rental demand.

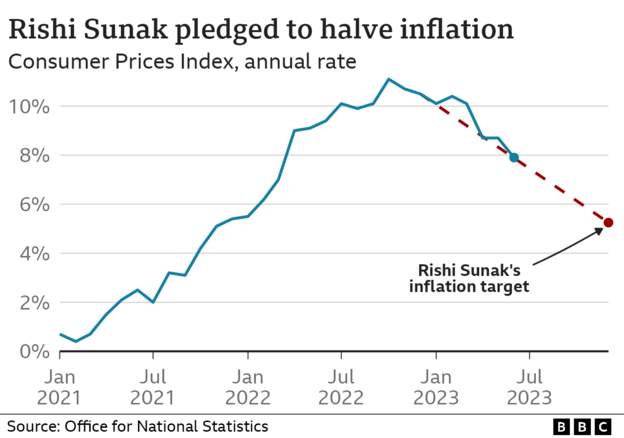

In summary, the unexpected fall in UK inflation to 7.9% in June 2023 has created a golden window for property investors. By taking advantage of the current market conditions, you could seize lucrative opportunities and set yourself up for long-term success.

It's important to remember that investing in property requires careful consideration and tailored advice from industry experts. As experts in UK property investment, we encourage you to explore this exciting opportunity with caution. Conduct thorough market research, consult with professionals, and evaluate your investment goals and risk appetite before making any decisions.

If you're considering property investment, don't miss out on the potential rewards this promising period offers. Reach out to me today to guide you through the process and help you make an informed decision.

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

Steven Oladipo

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...