Making sense of it all

From mini-budget to massive U-turn – it’s been quite the few weeks in the world of tax. But, once again, property investors are left asking one question: what does it all mean for me? Let’s take a look.

Debunking the Corporation Tax myth

The first point (and perhaps the most important) is this: not every investor using a limited company structure will pay the 25% Corporation Tax rate when it kicks in from April 2023. In fact, the government estimates that 70% of limited companies (about 1.4m of them!) will face no additional costs at all. Here’s how it works:

- The 25% rate only applies to limited companies making over £250,000 in annual profit

- If your limited company makes under £50,000 profit annually, your tax is capped at 19% (the Small Profits Rate)

- For anything in between, there’s a ‘tapered’ rate.

This means that the vast majority of investors will still pay 19% – which, for those on a Higher Rate band of Income Tax, will continue to mean vast savings. Clearly, this U-turn doesn’t spell the end of limited company investing.

Income Tax impact

One of Jeremy Hunt’s first acts as the new Chancellor was to reverse the previous proposal to cut the basic rate of income tax, from 20% to 19%. This means that the basic rate will remain at 20% – withdrawing what could’ve been an incentive for investors to buy in their own name, rather than through a limited company. As it stands, many will continue to enjoy higher profits through a limited company.

This is even more relevant for higher earners, following another U-turn: the decision to keep the 45% tax rate. For any investor in this higher band, it remains highly likely that limited company investing will be the road to lower taxes and better returns.

Stamp Duty still a winner

Some good news amid the madness – nothing’s changed on Stamp Duty. That means you’ll no longer need to pay any Stamp Duty Land Tax (SDLT) on the first £250,000 of the property value, delivering savings of up to £2,500. As mortgage rates continue to rise, this will be a welcome boost to investors.

To recap how this works, here’s a quick example:

Imagine you invest in a £250,000 property. Before the new measures, you’d pay no SDLT on the first £125,000, and 5% on the second £125,000 (2% SDLT, plus the 3% surcharge for additional dwellings).

But now, you won’t have to pay the 2% on the second £125,000 – you’ll just need to pay the 3% surcharge. That means a 2% saving, worth up to £2,500.

We’re glad to see that, despite the wider U-turns, the government is still committed to maintaining momentum in the property market. As with previous measures aimed at Stamp Duty, we expect this to encourage more appetite to buy, which can only be good news for capital growth.

Conclusion: Limited companies still solid

Before Kwasi Kwarteng’s mini-budget a few weeks ago, our position at GetGround was simple: for the majority of investors, investing with a limited company is the most secure, efficient, and profitable option.

And now? We’re saying the exact same thing.

The hike in Corporation Tax will affect only the largest companies, with most investors likely to feel no effects at all. And, with Income Tax unlikely to drop, 19% in Corporation Tax starts to look even more attractive. What’s more, you can still write off your mortgage interest with a limited company (which, as rates rise, could be the difference between making a profit or a loss over the next year).

Feeling uncertain about your next steps following the latest announcement? Arrange a free consultation with a GetGround property expert today, and see how a limited company could maximise your returns. If you want us to take care of your accounting and taxes, get started

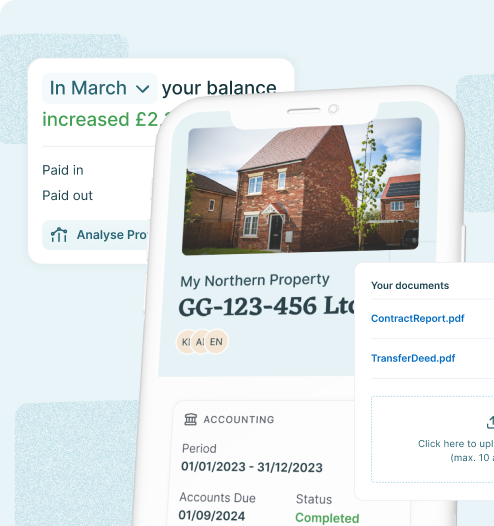

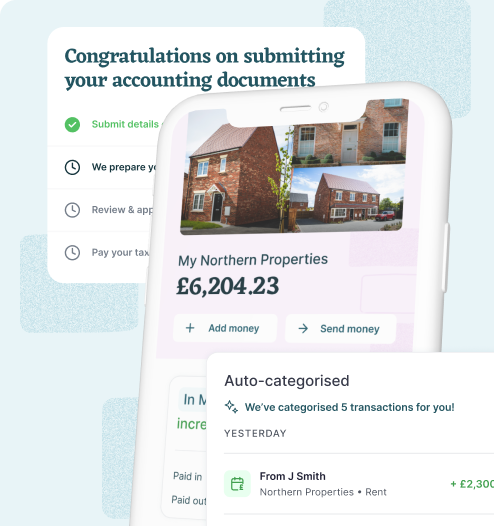

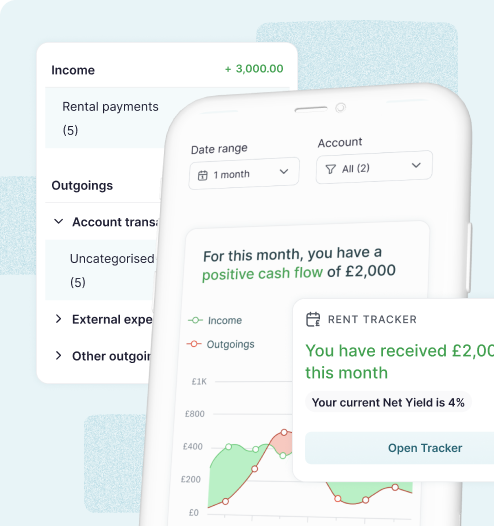

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

Chris Frame

Discover our recent property investing articles:

Making Tax Digital for Landlords: Digital Tax with a BTL Company

What is Making Tax Digital (MTD)?

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...