Investment into the buy-to-let asset class has continuously been considered a lucrative venture. Over recent years, the property investment market in the UK has undergone significant regulatory changes. This presents both challenges and opportunities for first-time investors looking to enter the market and existing landlords looking to expand their portfolios and grow their returns. Acknowledging the evolution of the UK property market and the changes landlords need to consider is vital for investors to remain profitable going forward.

Regulatory Changes Over The Years

Over the past decade, the UK property market has faced the implementation of various regulatory measures — from regulations relating to tax on property investments to changes in regulations around tenancy agreements. In 2015, a 3% stamp duty surcharge was added on buy-to-let properties and in 2023 the Renters Reform Bill was confirmed. This has meant landlords were required to navigate a web of changing regulations that impact everything from tax payments to tenancy agreements.

Although these changes are important for both landlords and tenants, as they ensure a clearer understanding of duties and rights, they also underscore the importance of staying informed and proactive in managing your property portfolio. Finding an accountant with experience in the property investment market; understanding the requirements to remain compliant; and using an investment strategy that allows landlords to remain adaptable are all important factors when considering property investment.

The limited company structure for property investment has become increasingly popular since 2016 as more tax regulations have been placed on landlords. In fact, 74% of buy-to-lets were bought using a limited company structure in 2023 as a result of the tax efficiencies they provide landlords. The prevalence of limited companies shows that it is an important structure to consider when investing in property.

Growing Financial Challenges

In addition to regulatory changes, landlords have faced a range of financial challenges such as rising mortgage rates and tax reforms. The end of the 5-year tax relief for landlords in 2021 and the increase in buy-to-let mortgage rates in 2023 have made profitable investing more challenging and have meant that investors need to seek out more efficient financing options.

Landlords have to search for more attractive mortgage options while keeping an eye on market and rate changes to ensure they can secure the best deal. Whether you're a seasoned landlord looking to expand your portfolio or a first-time investor entering the market, looking for buy-to-let specific mortgage options that facilitate a limited company structure can pose a challenge and can be made much simpler with the use of mortgage consultants.

The Benefits of an Effective Investment Strategy

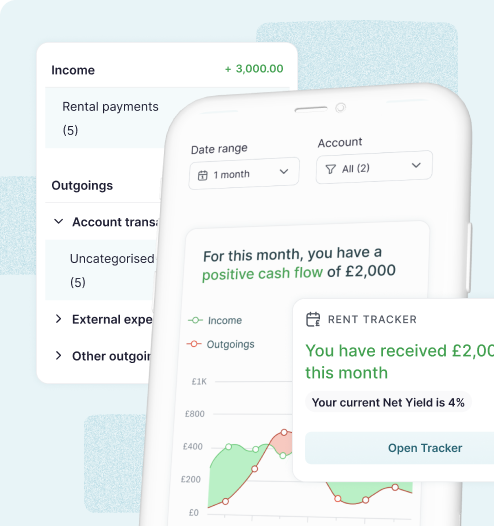

As the UK property market continues to evolve, landlords must be more strategic in their property investment journey, managing their portfolios in a way that allows for profitable returns but also mitigates risks that may come with new changes. This not only involves being aware of regulatory and financial updates but also optimising their property selection, finding the right financing strategy, and having an exit plan for when the time comes.

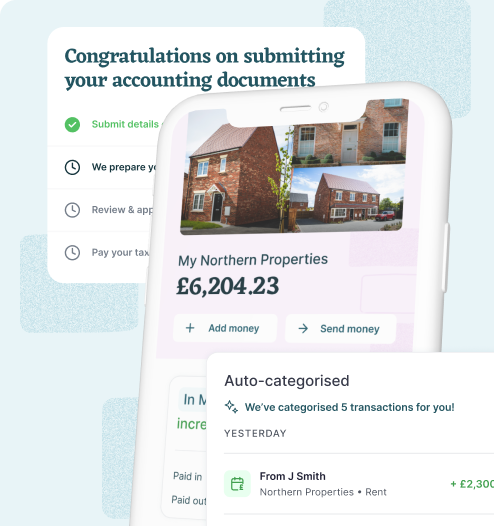

At GetGround, we’re committed to empowering property investors with the tools, resources and expertise needed to thrive in a complicated and evolving market. We aim to make the property investing journey more accessible and efficient through the use of our all-in-one platform. Whether you’re a portfolio landlord or a first-time investor, our products can help mitigate the challenges that come with the UK property market:

- Find the investment property that suits your goals: we use market data and couple that with advice from our specialist team to source properties that perfectly suit your budget and investment goals.

- Finance your investment seamlessly: we offer mortgages tailored to buy-to-let investor needs, providing attractive mortgage options with half the hassle.

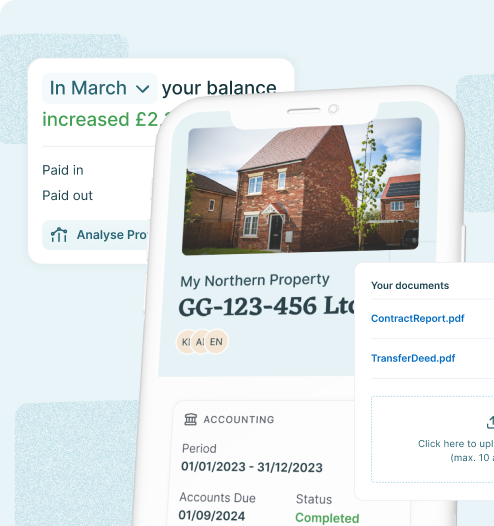

- Structure your property investment effectively: we set up your buy-to-let limited company, from filing with Companies House to managing your tax returns to automated share transfers between shareholders.

- Transfer to a limited company structure: to benefit from more efficient investing, we also facilitate transfers from personal ownership to a limited company structure.

- Exit your investment when the time comes: whether this is selling just one property or your entire portfolio, we make this process seamless while helping you maximise returns.

- Access cost-effective accounting and tax: from annual accounts preparation and filing to full secretarial services to a registered office and post management, our accounting and tax service helps landlords scale.

If you’re looking to streamline your property investment journey and benefit from an investing strategy that allows you to remain profitable within the UK market, book a call with our dedicated team now.

This is for your information only – you shouldn't view this as legal advice, tax advice, investment advice, or any advice at all. While we've tried to make sure this information is accurate and up to date, things can change, so it shouldn't be viewed as totally comprehensive. GetGround always recommends you seek out independent advice before making any investment decisions.

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

Making Tax Digital for Landlords: Digital Tax with a BTL Company

What is Making Tax Digital (MTD)?

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...