A recent survey by GetGround found that:

- A majority of buy to let landlords work full time

- Landlords younger than 40 are significantly more likely to purchase more buy to let properties in the future, and do so under a company structure

The survey was conducted with 125 participants who considered themselves landlords.

Among those surveyed, over 70% of those younger than 40 worked full-time, with less than 5% considering themselves full-time landlords. However, when looking at those over 40, only 50% are working full-time, and 20% consider themselves as full-time landlords. This follows a common understanding that full-time landlords tend to be older, and consider buy-to-let investing as a form of pension.

The younger demographic are also significantly more likely to increase their buy to let portfolio, with almost 80% saying they will either significantly or slightly increase the number of units in the future. It is only 25% for the same statistic for those older than 40.

And those younger than 40 are also materially more likely to purchase buy-to-let properties under a company structure. Around 80% answered that they are likely or very likely to do so, vs. around 28% of those older than 40.

The different age groups also invest for different reasons. Those younger than 40 are more likely to look at buy-to-let properties as a form of investment, extra income, and inheritance planning. For those older than 40, they consider buy-to-let properties primarily as a form of pension.

Structuring your property investment

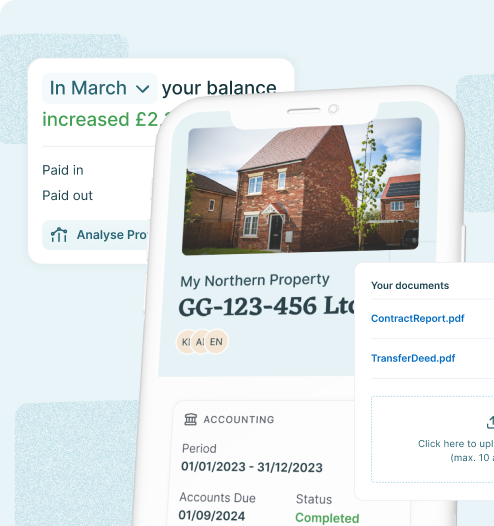

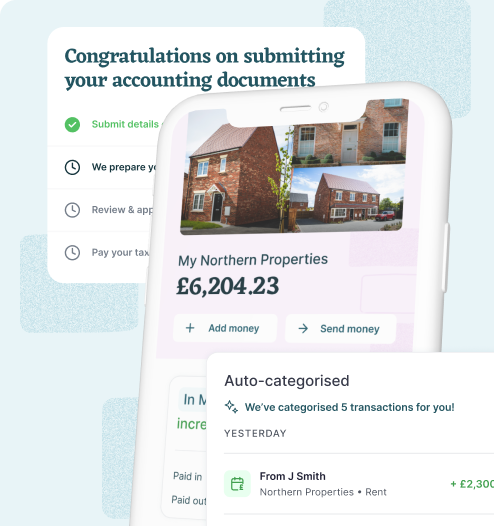

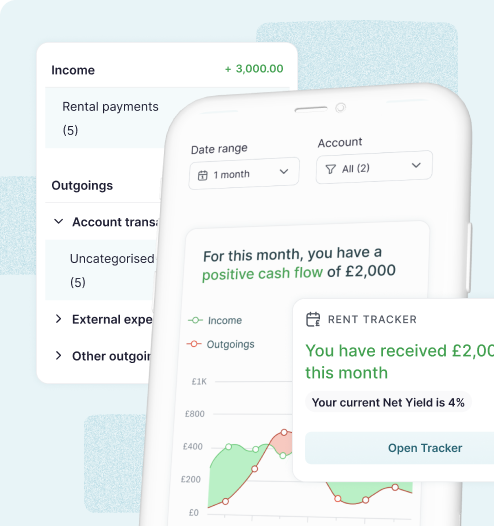

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

GetGround

GetGround

Discover our recent property investing articles:

Making Tax Digital for Landlords: Digital Tax with a BTL Company

What is Making Tax Digital (MTD)?

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...