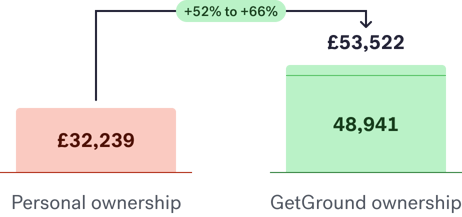

(1) Reviewed by our chartered accountants. Please ask for the full workings and assumptions. Some key assumptions are an investor is non-UK resident and taxed at Higher Rates in England, purchases a property for £500k producing a gross rent of £20k p.a.. Investor uses a 70% LTV interest only mortgage at 3% interest. The property’s value increases 3% p.a. and is sold after 5 years. All tax rates are based on 19/20 tax year. As with any illustration, this is a simplified position and does not take into account individual circumstances which could affect the tax outcomes. Tax legislation is complex and legislation is subject to changes in drafting as well as changes in interpretation by courts and tax authorities. The illustrations are not designed to be an exhaustive example of all the tax implications that may affect you and you should seek professional advice in considering the tax position appropriate to your circumstances.