Holding companies: a simpler route to Rome

Some investors only want one property. For others, it’s three, four, five. But then there’s everyone else – those with big, bold portfolio dreams.

Maybe you’re one of those dreamers. And, if you are, you’ll know it’s not easy. Rome wasn’t built in a day, after all. But as you build your Rome, ask yourself: should it be so difficult? Shouldn’t you be able to take your profits tax-efficiently, and put them back into your portfolio – again and again – stress-free?

We think so. This is why, today, we’re launching holding companies on the GetGround platform. For a simpler route to Rome, whatever that means for you and your portfolio.

“What is a holding company?”

Quite simply, it’s a company created for the sole purpose of owning and controlling other companies. Holding companies on the GetGround platform will contain the limited companies, or SPVs, that house each property in your portfolio.

“How will a HoldCo help me?”

For aspiring portfolio-builders, there’s three reasons to consider a holding company:

1. Easy reinvestment

Imagine you’ve made great profits in one of your SPVs. So now, naturally, you want to move some of that cash to another, and reinvest it in a new property.

Without a holding company, this can be either a) time-consuming and frustrating, or b) expensive. You’d either need to extract those profits personally, and then put them back into a new SPV, manually, or you’d need an intercompany loan, which has its own tax implications. Either way you’d be putting the brakes on your portfolio-building process, and cutting into your profits.

But what if both SPVs lived under the same holding company? Then, you could transfer assets between them easily – and, crucially, in a tax-neutral way. That means faster portfolio growth, and fewer administrative headaches.

2. Total flexibility when you sell

A holding company structure retains all the flexibility you already enjoy with SPVs. That is, when you choose to sell a property, you can either:

- Sell the shares in the SPV that owns the property

- Use the SPV to sell the property directly

Either way, the money stays in the group, ready for rapid re-investment.

3. Group Relief

Some investments do better than others. But, with a holding company, you can use Group Relief to offset one SPV’s losses against the profits of another. That could mean paying less Corporation Tax as a whole.

This way, holding companies help smooth out the impact of any struggling investments you might have. Group Relief, we should say, isn’t available for stand-alone SPVs. HMRC treats these as separate entities, rather than as part of a group.

“Is a holding company right for me?”

Holding companies are a great structure if you’re keen to build a larger portfolio, flexibly and efficiently. But there are two scenarios where maybe it’s not quite right for you:

1. Personal profit

If you’re less interested in reinvesting, and more focused on extracting your profits directly, then a holding company probably isn’t right for you.

That’s because, if you sell shares in one of your SPVs, you could end up getting taxed twice: Corporation Tax first when you sell the SPV shares, and then Capital Gains Tax when you extract the profits from the holding company (as dividends, for example). So it may be easier in this case to maintain a one property, one SPV structure – without a holding company.

2. Split inheritance

If you want to leave one property to one beneficiary, and one property to another, it makes sense to keep them separate. Still housed in their own SPVs, of course – but without a holding company. This makes it easier for each beneficiary to realise the value of their assets, without any additional difficulty or tax implications from the holding company.

Holding companies at GetGround

At GetGround, we’re all about making landlords’ lives stress-free and simple. And, if you decide a holding company is the right route for you, we’ll set yours up for you in just half an hour. Your first SPV, too.

Wondering if a holding company’s right for you? Explore how it works with a free consultation, led by our HoldCo experts. Arrange yours today, and discover everything a holding company has to offer you and your portfolio.

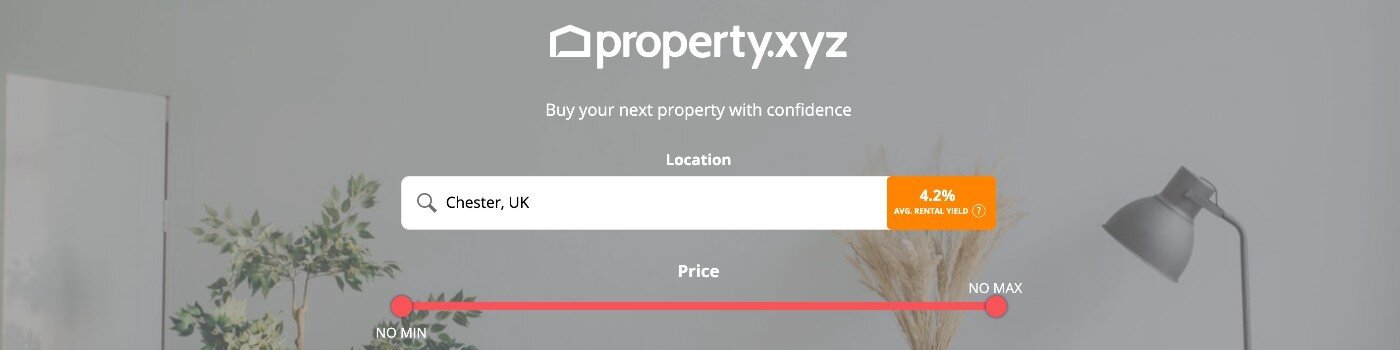

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

Partner Spotlight: Property Investments UK

Robert Jones, the founder of the Property Investments UK,assists investors from the UK and worldwide in navigating the UK property market, from ...

Partner Spotlight: Qube Residential

GetGround caught up with Jonathan Cook from Qube Residential, a sales, letting and property management firm, with a spotlight on our ongoing ...

Why you need to visit GetGround's stall at the Property Investor Show

This year’s Property Investor Show is right around and is a must-go event for anyone looking for profitable property investment. In 2022, we attended ...