The concept of buy-to-let is nothing new – it’s a term most people have heard of and has been a popular choice for investors for many years. In the UK, around 12% of the entire mortgage market is made up by buy-to-let loans, making it a significant part of the property landscape. But how do you actually make money from buy-to-let investing and what should new investors be considering when eyeing a move into the market?

One of the reasons buy-to-let investment is popular is that it makes money for people in two different ways: rental yields and capital appreciation. If you’re looking to invest, it’s critical to not just understand both of these but also have a view on which one is most important to you as this will ultimately drive the decision on which property you invest in.

Understanding rental yields

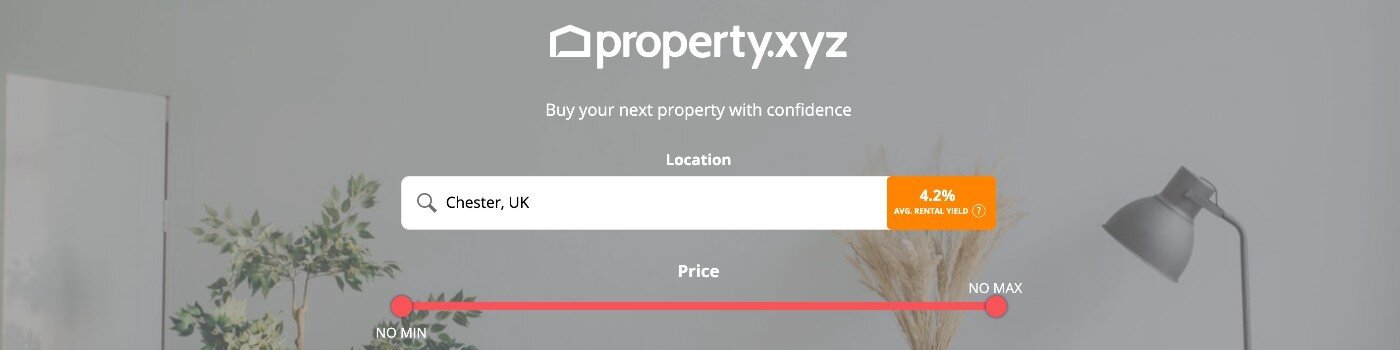

Essentially, rental yield is the value of the rent you can expect to receive from your property in a year in relation to the money you paid for it. This annual return can roll on over a long period, as long as you continue to rent your property. The higher the yield, the better the return-on-investment.

You can estimate your rental yield before you buy a property – estate agents will often include the expected gross rental yield on the listing. It’s calculated by taking the annual rent of the property, dividing it by the value of the property and multiplying by 10.

For example if the property has an expected rental income of £15,000 per year, and it’s valued at £200,000, the gross rental yield is 7.5%. As a general rule, this calculation means that you find higher rental yields in places with lower house prices but where good rents can still be charged.

Understanding capital appreciation

Capital appreciation or capital gain is the money you make because your property has increased in value over time. This is something that comes into play if and when you sell the property. Although this is more of a long-term consideration, it has increasingly become more important over the past few years as property prices across the country have soared and made many investors money in a short space of time.

In fact, the valuation of Britain's £7.6 trillion property market continues to hit new records. It has outstripped the performance of FTSE All Share index, cash and gold over the past 20 years, with property prices doubling, on average, every 10-15 years.

Which one should you be considering more?

Most buy-to-let investors benefit from both types of return, so they are important to everyone. But the type of return that you choose to focus on when purchasing a property makes a difference to where and what you buy.

Those who focus on rental yields tend to be looking to add to their regular income in the short-term and could be looking at the investment as a second pension. Those focusing on capital appreciation are looking at the long-term, and might be considering funding retirement in the future, supporting children or simply hedging against poor returns on savings.

What kind of property to look for based on return

Where and what to buy will be dependent on what your investment goals are and which of these two returns are of more interest to you.

London has great capital appreciation returns, but house prices are high and the rental yield relatively quite low. This has been compounded by the pandemic which according to Hamptons, has seen rental yields falling 17.7% in February compared with the same time last year while house prices remain fairly stable. The FT reported that the average London rental yield in fact dipped down to 3.8% in December 2020.

The inverse is true for rural areas and generally places up north with lower property prices. According to InventoryBase, Scotland, Wales and the North East have the best rental yields at the moment (5.12%, 4.52% and 4.29% respectively) with Glasgow (7.52%) coming out as the top city for yields.

Another strong choice for rental yields is commuter towns, which generally have high figures – especially on the outskirts of London – where homes are more affordable but tenant demand is high.

Finally, according to Hamptons, flats offer higher yields than houses – last year, in 83% of local authorities, flats offered higher average gross yields than any type of house.

For anyone looking at lower yield investments, it’s important to keep in mind that it will be increasingly more difficult to get buy-to-let mortgages, which base their interest rate on rental yield, not necessarily the borrower’s credit rating.

For those looking for great capital appreciation, as discussed, London is still a strong option and so too are other heavily populated cities across the country. Take the example of London’s capital appreciation: £100 invested in London’s property market twenty years ago would be worth £1,290 today. Meanwhile, the same amount invested into the FTSE All Share index would be £525, while gold would be £355 and cash savings £266.

Beyond those areas, investors should look out for areas that are regenerating. There are pockets of regeneration across the country which are seeing house prices soar from a low base where great long-term returns can be made. According to Seven Capital, Birmingham, Leeds, and Derby have experienced a strong regeneration as of late.

Can’t decide where your preference lies? If you’re on the fence and want to try and go for good results on both returns, the likes of Manchester and Liverpool are getting both good rental yield and capital appreciation.

Final thoughts

Buy-to-let investing ultimately remains an attractive asset class, although there have been changes to tax regulations in the recent past that may have negatively affected investors. Continuing low interest rates mean that buy-to-let returns are still performing better than alternative investment options, and especially cash sitting in a savings account. The key to success is understanding your own goals in relation to capital appreciation and rental yield - this can ultimately help you decide if and where you should invest.

Finding your buy-to-let property

GetGround's property marketplace hosts a range of vetted new-build and second-hand properties that investors can use to start or build their portfolios. GG Search helps you make an informed decision about your next property investment by equipping you with interactive costs and returns reports. Ready to find your next buy-to-let investment?

GetGround

GetGround

Discover our recent property investing articles:

Partner Spotlight: Property Investments UK

Robert Jones, the founder of the Property Investments UK,assists investors from the UK and worldwide in navigating the UK property market, from ...

Partner Spotlight: Qube Residential

GetGround caught up with Jonathan Cook from Qube Residential, a sales, letting and property management firm, with a spotlight on our ongoing ...

Why you need to visit GetGround's stall at the Property Investor Show

This year’s Property Investor Show is right around and is a must-go event for anyone looking for profitable property investment. In 2022, we attended ...