UK borrowing has hit a peacetime high as the Government deals with the economic and health impact of Covid. This Budget has sought to both continue support for the economy as it emerges from what the Government hopes is the final lockdown in response to Covid, as well as begin the task of repairing the UK’s finances. The success of the UK vaccination programme has given economists hope that the economic rebound in 2021 will be substantial.

Below we provide our initial reaction to the Budget’s impact on company Buy-to-Let ownership. There are many benefits from holding Buy-to-Let property in a company structure. GetGround makes it easy and cost-effective for Buy-to-Let investors to purchase their investment property through a UK Limited company.

Small companies escape Corporation Tax increases.

The Chancellor is increasing Corporation Tax from 19% to 25% (taking effect in April 2023), however companies which have profits of £50k or less are protected and will remain at the current Corporation Tax rate of 19%. This small profits rate, as it existed in 2014 before it was axed by George Osborne, applied to companies holding Buy-to-Let property.

As a result, for GetGround customers we expect no increase in Corporation Tax. Furthermore the GetGround model of holding only one property per company now provides an additional advantage of creating a structure that will almost always benefit from the small profit rate of Corporation Tax given it is unlikely that one property produces profit exceeding the threshold.

We should also note that the Chancellor has cancelled any planned increases in the Income Tax personal allowance until 2024 effectively dealing a blow to landlords who qualify for this relief and hold Buy-to-Let property in their personal name.

Stamp Duty holiday extended.

The Stamp Duty Land Tax holiday, where a nil rate is applied to property values upto £500,000, has been extended to 30 June 2021. Thereafter and until 30 September 2021 the nil rate will apply to property values up to £250,000 before returning to the pre-Covid level of £125,000 in October 2021. We believe the savings from this initiative will continue to support transaction volumes through to the final quarter of 2021.

Owning Buy-to-Let property through a company creates flexibility for investors.

Buy-to-Let property is often a long term investment. Over long time horizons many circumstances can change for an individual. It is therefore comforting to many investors that owning Buy-to-Let property through a company creates flexibility. Examples of this include:

- A flexible ownership structure where existing or new investors can change ownership in the company by selling and buying shares.

- Greater legal protections afforded by company formation documents including a Shareholders' Agreement and Articles of Association.

- More flexible inheritance and estate planning.

- Multiple routes to extract profits from the company including owner loans, dividends, pension contributions and liquidations.

- Additional routes to exit the investment and drive returns. Choose to sell the property or to sell the shares in the company.

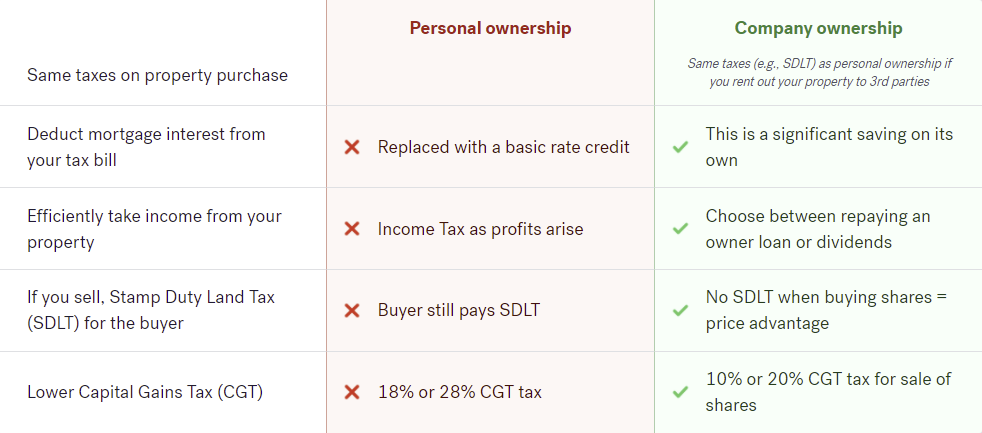

Company ownership opens the door to multiple tax efficiencies.

The many benefits of owning Buy-to-Let property in a company are driving record numbers of companies being incorporated for this purpose. Last year alone there were 41,700 (source: Hamptons) companies incorporated in the UK for Buy-to-Let. One of these benefits are tax efficiencies which we summarise in the table below.

We are here to help.

At GetGround we want to educate people about the benefits of company Buy-to-Let, then make it easy and cost-effective to execute.

The rental sector is huge and growing. It plays a crucial role in life in the UK. We believe by increasing company Buy-to-Let we can change the rental sector for the better by:

- Reducing costs translating to better returns for investors.

- Professionalising the industry and thereby raising rented property standards making it safer and more enjoyable for tenants.

- Increasing transparency and improving governance by bringing company structure and law to the industry.

In the following days details of the headline announcements in the Budget will be released by the Treasury. We will review this and follow up on this article to provide further detailed insight into the changing landscape for the Buy-to-Let investor. In the meantime if you have any questions please visit our website (www.getground.co.uk) or email us on info@getground.co.uk.

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

GetGround

GetGround

Discover our recent property investing articles:

Partner Spotlight: Qube Residential

GetGround caught up with Jonathan Cook from Qube Residential, a sales, letting and property management firm, with a spotlight on our ongoing ...

Why you need to visit GetGround's stall at the Property Investor Show

This year’s Property Investor Show is right around and is a must-go event for anyone looking for profitable property investment. In 2022, we attended ...

Landlords, grow your returns with GetGround's Investment Pot

If you're a landlord with a limited company on the GetGround platform, you've probably heard of business accounts. Our business accounts are designed ...